All Categories

Featured

Table of Contents

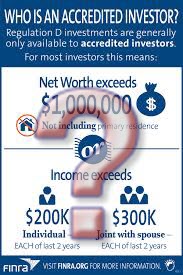

Investments involve risk; Equitybee Stocks, member FINRA Accredited investors are the most professional investors in business. To qualify, you'll need to meet one or more demands in revenue, web well worth, possession size, governance standing, or expert experience. As an approved financier, you have access to much more complex and advanced sorts of safety and securities.

Enjoy access to these alternative financial investment opportunities as a certified financier. Continue reading. Accredited capitalists usually have an earnings of over $200,000 individually or $300,000 collectively with a spouse in each of the last 2 years. AssetsPrivate CreditMinimum InvestmentAs low as $500Target Holding PeriodAs short as 1 month Percent is a personal credit scores financial investment platform.

Comprehensive Accredited Investor Syndication Deals

To make, you simply need to register, spend in a note offering, and await its maturation. It's an excellent source of passive revenue as you do not need to monitor it closely and it has a short holding period. Excellent yearly returns range between 15% and 24% for this property course.

Prospective for high returnsShort holding duration Funding in danger if the consumer defaults AssetsContemporary ArtMinimum Investment$15,000 Target Holding Period3-10 Years Masterworks is a system that securitizes blue-chip artworks for financial investments. It gets an art work via auction, then it registers that possession as an LLC. Beginning at $15,000, you can purchase this low-risk asset class.

Purchase when it's provided, and afterwards you receive pro-rated gains when Masterworks sells the artwork. Although the target period is 3-10 years, when the art work reaches the wanted worth, it can be marketed earlier. On its site, the most effective recognition of an artwork was a monstrous 788.9%, and it was only held for 29 days.

Yieldstreet has the widest offering across alternate investment systems, so the quantity you can gain and its holding duration differ. There are items that you can hold for as short as 3 months and as long as 5 years.

Accredited Investor Alternative Asset Investments

It can either be paid to you monthly, quarterly, or as soon as an occasion takes place. Among the drawbacks right here is the lower annual return rate compared to specialized systems. It provides the same items, some of its competitors outperform it. Its monitoring cost normally ranges from 1% - 4% yearly.

In enhancement, it gets rent earnings from the farmers during the holding period. As a financier, you can gain in 2 methods: Obtain dividends or cash money yield every December from the rent paid by tenant farmers.

Turnkey Exclusive Investment Platforms For Accredited Investors for Accredited Investor Deals

Farmland as a possession has traditionally low volatility, which makes this a great choice for risk-averse investors. That being said, all financial investments still carry a certain degree of risk.

Furthermore, there's a 5% cost upon the sale of the entire building. It invests in numerous bargains such as multifamily, self-storage, and commercial homes.

Managed fund by CrowdStreet Advisors, which instantly diversifies your investment throughout different buildings. accredited investor real estate investment networks. When you invest in a CrowdStreet offering, you can receive both a money yield and pro-rated gains at the end of the holding period. The minimal financial investment can vary, however it typically begins at $25,000 for market offerings and C-REIT

Property can be generally reduced threat, however returns are not ensured. While some possessions might return 88% in 0.6 years, some possessions lose their value 100%. In the background of CrowdStreet, greater than 10 buildings have unfavorable 100% returns. CrowdStreet does not bill any kind of charges, however you could require to pay sponsors fees for the management of the residential or commercial properties.

All-In-One Accredited Investor Crowdfunding Opportunities for Accredited Investment Portfolios

While you will not obtain possession here, you can possibly obtain a share of the earnings once the start-up effectively does an exit occasion, like an IPO or M&A. Several excellent business stay private and, therefore, often unattainable to financiers. At Equitybee, you can fund the stock options of workers at Stripe, Reddit, and Starlink.

The minimal investment is $10,000. This platform can possibly offer you huge returns, you can additionally lose your entire cash if the startup stops working. Considering that the transfer of the protections is manual, there's a risk that workers will certainly refuse to follow by the agreement. In this situation, Equitybee will certainly exercise its power of attorney to inform the company of the stock to launch the transfer.

When it's time to exercise the option throughout an IPO or M&A, they can profit from the potential increase of the share cost by having an agreement that permits them to acquire it at a discount (accredited investor secured investment opportunities). Accessibility Numerous Start-ups at Past Valuations Diversify Your Portfolio with High Growth Start-ups Buy a Formerly Inaccessible Asset Course Topic to schedule

It can either be 3, 6, or 9 months long and has a fixed APY of 6% to 7.4%. Historically, this revenue fund has outmatched the Yieldstreet Option Revenue Fund (previously recognized as Yieldstreet Prism Fund) and PIMCO Income Fund.

Accredited Investor Growth Opportunities

Various other functions you can spend in consist of buying and holding shares of commercial rooms such as industrial and multifamily buildings. Some customers have actually complained about their lack of transparency. Apparently, EquityMultiple doesn't connect losses without delay. Plus, they no longer release the historic performance of each fund. Temporary note with high returns Absence of transparency Complex fees framework You can qualify as a recognized capitalist utilizing two standards: economic and specialist capabilities.

There's no "test" that approves an accreditor capitalist license. One of the most crucial things for a recognized capitalist is to shield their capital and grow it at the exact same time, so we chose possessions that can match such different threat cravings. Modern spending systems, particularly those that supply different assets, can be fairly unforeseeable.

To ensure that certified investors will be able to form a thorough and varied portfolio, we picked platforms that might fulfill each liquidity demand from temporary to lasting holdings. There are various investment opportunities approved investors can explore. Some are riskier than others, and it would certainly depend on your threat hunger whether you would certainly go for it or not.

Approved financiers can expand their financial investment portfolios by accessing a broader array of possession classes and investment methods. This diversity can help alleviate risk and enhance their overall profile performance (by staying clear of a high drawdown portion) by lowering the dependancy on any kind of solitary investment or market field. Accredited investors commonly have the possibility to connect and team up with various other like-minded financiers, market experts, and business owners.

Latest Posts

Accredited Real Estate Investing

Preferred Investment Platforms For Accredited Investors with Accredited Investor Returns

Verify Accredited Investor Status